Counterpoint: Apple was #1 in 2025 in terms of smartphone shipments, Samsung fell to #2

- Posted on Jan. 12, 2026, 5 p.m.

Apple Soars to #1 in 2025 Global Smartphone Shipments, Samsung Follows Closely

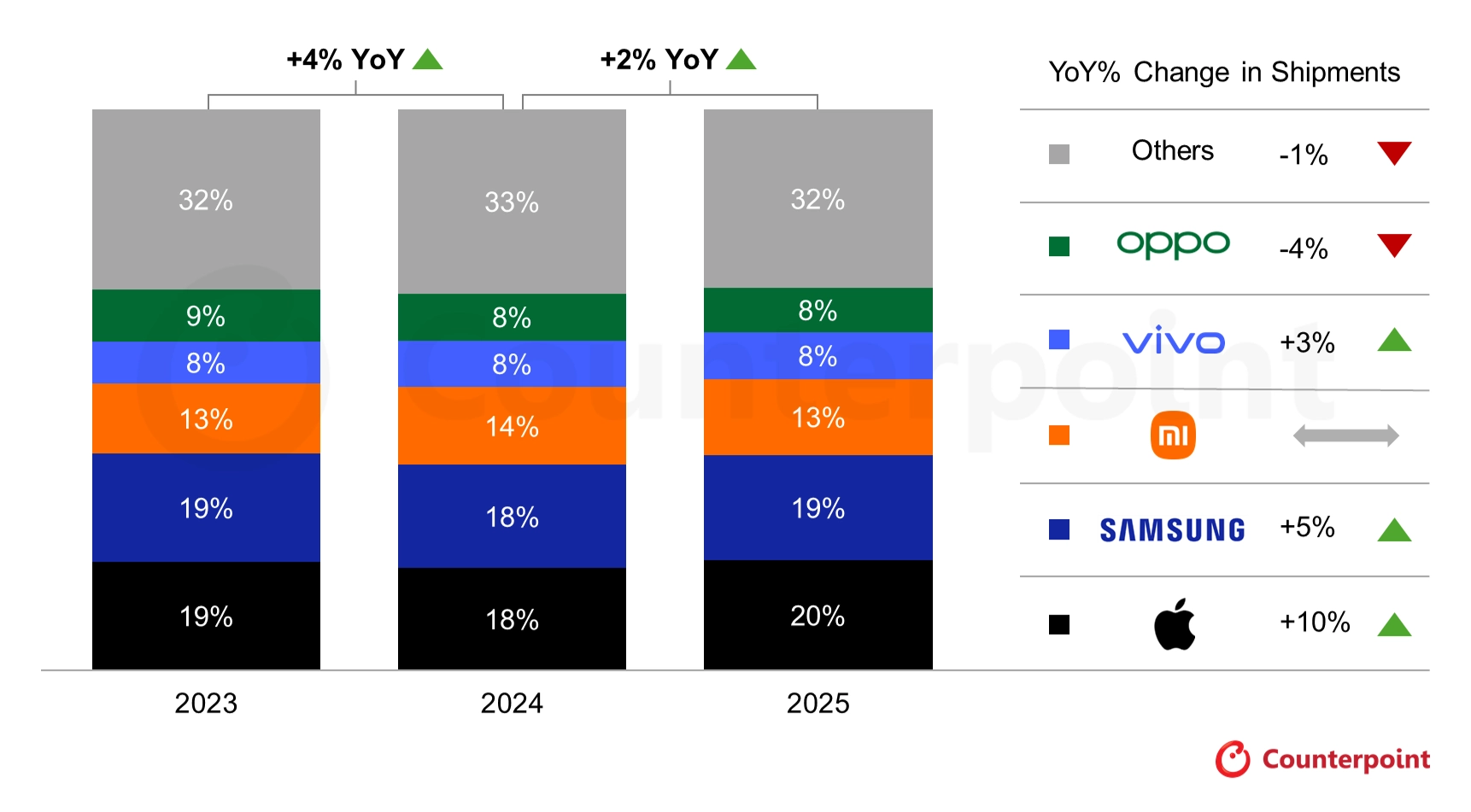

The global smartphone market witnessed a modest but encouraging rebound in 2025. Preliminary data from Counterpoint Research indicates a slight 1% increase in smartphone shipments during the final quarter of the year, contributing to an overall 2% growth for the full year. This marks the second consecutive year of positive growth, signaling a steady recovery in the dynamic tech industry.

Apple Dominates Global Smartphone Market Share in 2025

As anticipated, Apple clinched the top spot, emerging as the world's largest smartphone manufacturer in 2025. The Cupertino giant secured an impressive 20% market share, meaning one out of every five smartphones shipped globally bore the iconic Apple logo. This remarkable achievement was fueled by strong performance across its product lines, with Apple's shipments growing by a significant 10% year-on-year – the highest growth among the top five manufacturers.

Key drivers behind Apple's success included sustained demand for the well-established iPhone 16, particularly in markets such as Japan, India, and Southeast Asia. Furthermore, the newly launched iPhone 17 series experienced escalating demand. Counterpoint analysts suggest that a lingering effect from the COVID era, which disrupted traditional upgrade cycles, played a crucial role, pushing millions of users to finally update their devices in 2025.

Samsung Secures Second Place with Strong Galaxy Performance

While Samsung settled for the second position in 2025 global smartphone shipments, the South Korean tech behemoth posted a solid 5% growth, outperforming several competitors within the top five. Samsung's premium segment saw a significant boost from robust sales of the Galaxy S25 series and the innovative Galaxy Z Fold7, both of which surpassed their predecessors in popularity. Concurrently, the burgeoning demand for the accessible Galaxy A-series reinforced Samsung's strength in the mid-range smartphone market.

Top Smartphone Brands: Xiaomi Holds Steady, Vivo Overtakes Oppo

Elsewhere in the competitive landscape:

- Xiaomi maintained its strong position at number three, capturing a consistent 13% market share. The company saw particular success in key regions like South America and Southeast Asia.

- vivo demonstrated commendable growth of 3%, successfully swapping places with rival Oppo. This shift is attributed to strong demand for vivo's smartphone offerings in India.

- Oppo, on the other hand, experienced a 4% decline, struggling amidst intense market competition within China and the broader Asia-Pacific region.

Rising Stars: Nothing and Google Show Impressive Growth

Beyond the established top five, Counterpoint Research highlighted two brands exhibiting remarkable growth throughout 2025. Nothing saw an astounding 31% increase in shipments, while Google registered a significant 25% growth, signaling their potential as disruptors in the evolving smartphone ecosystem.

2026 Outlook: Potential Headwinds for Smartphone Market Growth

Looking ahead, the momentum of annual growth could face challenges in 2026. According to Research Director Tarun Pathak, "The global smartphone market is set to soften in 2026 amid DRAM/NAND shortages and rising component costs, as chipmakers prioritize AI data centers over smartphones. Price hikes in smartphones have already begun to surface." In light of these factors, Counterpoint has revised its forecast for 2026, reducing shipment estimates by 3%.

Source

0 Responses Write a Response